Top 10 Auto Insurance Companies Offering Affordable Car Insurance for Teens

Finding affordable car insurance for teens at top 10 auto insurance companies can feel like an uphill battle. Insurance providers typically charge teens significantly higher premiums due to their lack of driving experience and higher statistical risk of accidents. In fact, adding a teen driver to your policy can increase your premium by 50% to 100%, depending on your location and insurance provider. However, with the right knowledge and strategy, you can find reasonable rates and valuable discounts that make insuring your teen driver more affordable. This comprehensive guide examines the top 10 auto insurance companies offering competitive rates for teen drivers, highlighting special discounts, unique programs, and features designed specifically for young drivers. We'll also provide practical tips to help parents reduce premiums while maintaining adequate coverage for their teens.

How We Selected the Best Insurance Companies for Teen Drivers

To identify the best car insurance companies for teen drivers, we evaluated insurers based on several key factors:

- Cost: Average annual premiums for teen drivers, both on their own policies and when added to parents' policies

- Discounts: Availability and value of teen-specific discounts such as good student, driver training, and student-away-at-school discounts

- Safety Programs: Special programs designed to promote safe driving habits among teens

- Customer Satisfaction: Ratings from J.D. Power, NAIC complaint index, and customer reviews

- Coverage Options: Variety and flexibility of coverage options suitable for teen driver

- Financial Strength: Company's ability to pay claims, as rated by organizations like AM Best

- Digital Tools: Quality of mobile apps and online resources for policy management

Our analysis combines data from industry reports, customer reviews, and quotes from each company to provide a comprehensive picture of what each insurer offers teen drivers and their families.

Ready to Find the Best Rate for Your Teen Driver?

Compare personalized quotes from multiple insurers to find the most affordable coverage for your teen driver.

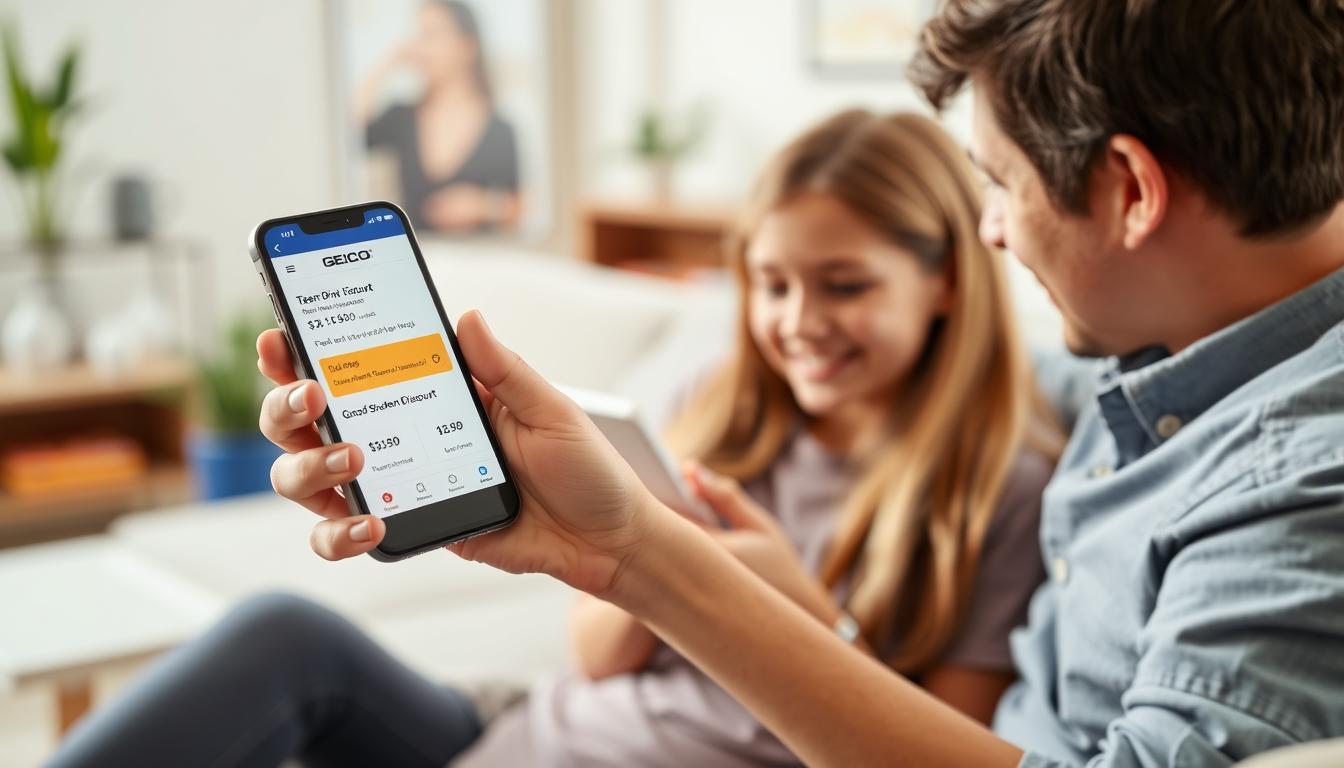

1. GEICO: Best Overall Value for Teen Drivers

- Report the accident to your insurance company as soon as possible

- Document the damage with photos, videos, and notes

- File a claim through your insurer's preferred method (app, phone, online)

- Claim investigation by an insurance adjuster

- Damage evaluation and cost estimation

- Claim resolution and settlement offer

- Payment for repairs or replacement

The efficiency and customer experience during these steps can vary significantly between providers. Let's examine how the top 10 auto insurers handle this process.

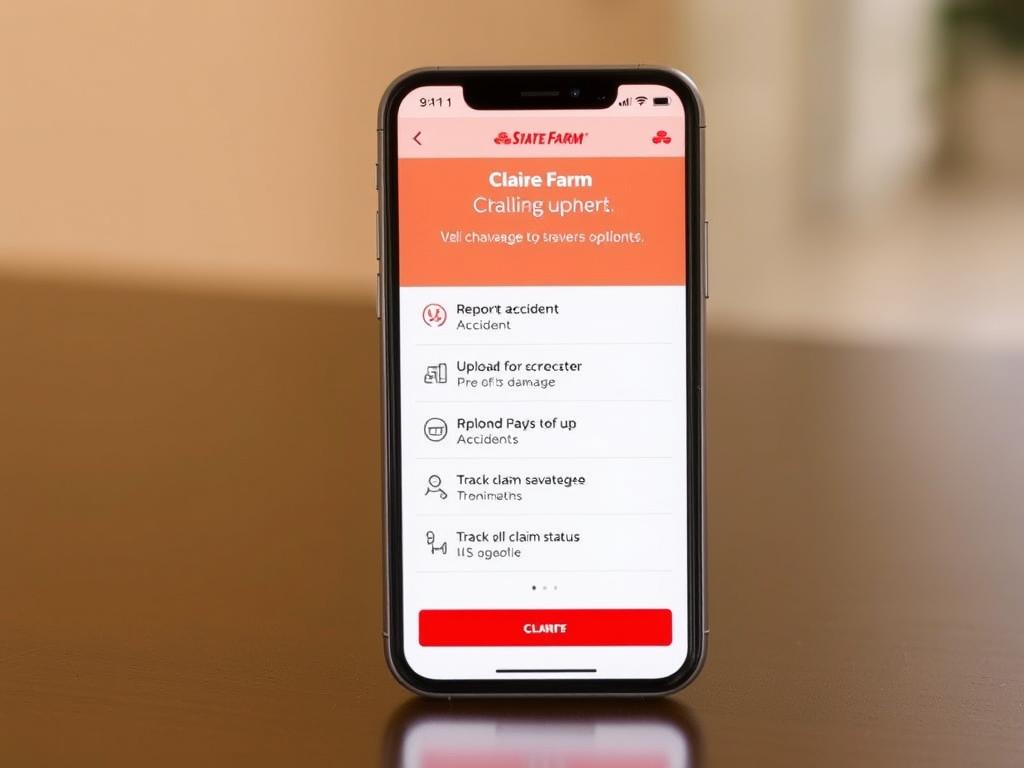

State Farm Insurance Claims Process

Overall Rating

State Farm offers competitive rates for teen drivers with an average annual premium of $1,500 for teens with their own policies. The company stands out for its generous student discounts and programs specifically designed for young drivers.

Available Discounts for Teen Drivers

- Good Student Discount: Up to 25% off for students with good grades (one of the highest in the industry)

- Student Away at School Discount: Savings when your student is away at school without a car (100+ miles from home)

- Driver Training Discount: Discount for completing an approved driver education course

- Steer Clear Safe Driver Discount: Additional savings after completing State Farm's safe driving program

Unique Features for Teen Drivers

- Steer Clear Program: A driver training app specifically designed for drivers under 25 that can lead to discounts upon completion

- Drive Safe & Save: Usage-based insurance program that tracks driving habits and rewards safe driving

- Local Agent Support: Personalized guidance from a local agent who can help navigate teen driver insurance

Pros: Exceptional student discounts (up to 25%) Dedicated teen driver programs Strong local agent network for personalized service Excellent financial strength (A++ rating from AM Best)

Cons: Slightly higher base rates than some competitors Must work through an agent (no direct online purchase) No gap insurance available

Connect with State Farm

Speak with a local agent about special discounts for your teen driver.

3. Progressive: Best for Customizable Coverage

Overall Rating

Progressive offers teen drivers an average annual premium of $1,670 for their own policies. The company stands out for its highly customizable coverage options and innovative tools that help families find the right balance of coverage and affordability.

Available Discounts for Teen Drivers

- Good Student Discount: Savings for students maintaining a B average or better

- Distant Student Discount: Reduced rates when your student is away at school without a car

- Teen Driver Discount: Special savings specifically for teen drivers

- Multi-Policy Discount: Savings when bundling auto with home, renters, or other policies

Unique Features for Teen Drivers

- Snapshot Program: Usage-based insurance that monitors driving habits and can lead to discounts for safe driving

- Name Your Price Tool: Helps families find coverage options that fit their budget

- Small Accident Forgiveness: Claims less than $500 won't increase your rate

- Deductible Savings Bank: Reduces your collision deductible by $50 for every claim-free policy period

Pros: Highly customizable coverage options Innovative tools for finding affordable coverage Multiple discount opportunities Strong digital experience with robust mobile app

Cons: No driver training discount Rates can increase significantly after claims Customer service ratings are average

Customize Your Teen's Coverage

Use Progressive's Name Your Price tool to find coverage that fits your budget.

4. USAA: Best for Military Families

Overall Rating

USAA offers exceptional rates for teen drivers in military families, with an average annual premium of $1,289 for teens with their own policies. USAA consistently ranks among the most affordable options for teen drivers, though membership is limited to military members, veterans, and their families.

Available Discounts for Teen Drivers

- Good Student Discount: Savings for students with good grades

- Driver Training Discount: Discount for completing an approved driver education course

- Family Discount: Special savings when parents are also USAA members

- Military Installation Discount: Up to 15% off when your vehicle is garaged on a military base

Unique Features for Teen Drivers

- SafePilot Program: Usage-based insurance program that monitors driving habits and rewards safe driving

- Military Deployment Vehicle Storage: Reduced rates when storing a vehicle during deployment

Pros: Consistently lowest rates for eligible families Exceptional customer service ratings Strong financial stability (A++ rating from AM Best) Comprehensive mobile app for policy management

Cons: Limited eligibility (military families only) No local agents available No gap insurance option

Military Family? Check USAA Rates

See why USAA is consistently rated best for military families with teen drivers.

5. American Family: Best for Teen Safety Programs

Overall Rating

American Family offers teen drivers an average annual premium of $2,273 for their own policies. While not the cheapest option, American Family stands out for its comprehensive teen safety programs and substantial student-away-at-school discount of up to 16%.

Available Discounts for Teen Drivers

- Good Student Discount: Up to 5% off for students with good grades

- Student Away at School Discount: Up to 16% off when your student is away at school without a car

- Teen Safe Driver Program Discount: Up to 10% off after one year of participation

- Young Volunteer Discount: Savings for teens who volunteer in their communities

Unique Features for Teen Drivers

- Teen Safe Driver Program: Uses in-car technology to monitor driving habits and provide coaching to improve skills

- Diminishing Deductible: Your deductible decreases by $100 each year you're claim-free (up to $500)

- Accident Forgiveness: No rate increase after your first at-fault accident

- KnowYourDrive: Usage-based insurance program that can lead to discounts based on safe driving habits

Pros: Industry-leading teen safety programs Generous student-away-at-school discount Strong local agent network Very low complaint ratio with NAIC

Cons: Higher base rates than some competitors Available in only 19 states Good student discount is lower than competitors

Protect Your Teen Driver

Learn more about American Family's Teen Safe Driver Program and special discounts.

6. Travelers: Best for Budget-Conscious Families

Overall Rating

Travelers offers some of the most affordable rates for teen drivers, with an average annual premium of $1,249 for teens with their own policies. This makes Travelers an excellent choice for budget-conscious families looking to minimize the financial impact of adding a teen driver.

Available Discounts for Teen Drivers

- Good Student Discount: Savings for students with a B average or better

- Student Away at School Discount: Reduced rates when your student is away at school without a car

- Driver Training Discount: Discount for completing an approved driver education course

- Early Quote Discount: Savings when you get a quote before your current policy expires

Unique Features for Teen Drivers

- IntelliDrive Program: Usage-based insurance that monitors driving habits via smartphone app and can lead to discounts

- Responsible Driver Plan: Includes accident forgiveness and minor violation forgiveness

- Premier New Car Replacement: Replaces your new car with a brand new one if it's totaled within five years

Pros: Consistently low rates for teen drivers Multiple discount opportunities Strong financial stability (A++ rating from AM Best) Comprehensive coverage options

Cons: Average customer service ratings Mobile app receives mixed reviews Good student discount is lower than some competitors

Save with Travelers

Get a quote from one of the most affordable insurers for teen drivers.

7. Nationwide: Best for Customizable Discounts

Overall Rating

Nationwide offers teen drivers an average annual premium of $2,347 for their own policies. While not the cheapest option, Nationwide stands out for its extensive discount programs and highly customizable coverage options.

Available Discounts for Teen Drivers

- Good Student Discount: Up to 4% off for students with a B average or better

- Student Away at School Discount: Up to 5% off when your student is away at school without a car

- SmartRide Discount: Up to 40% off based on safe driving habits

- Accident-Free Discount: Savings for maintaining an accident-free record

Unique Features for Teen Drivers

- SmartRide Program: Usage-based insurance that monitors driving habits and can lead to significant discounts

- Vanishing Deductible: $100 off your deductible for each year of safe driving (up to $500)

- Accident Forgiveness: No rate increase after your first at-fault accident

- Roadside Assistance: 24/7 emergency assistance for breakdowns, lockouts, and more

Pros: Extensive discount opportunities Highly customizable coverage options Strong financial stability (A+ rating from AM Best) Very low complaint ratio with NAIC

Cons: Higher base rates than some competitors Good student discount is lower than industry average Not available in Alaska, Hawaii, Louisiana, or Massachusetts

Customize Your Coverage

Explore Nationwide's customizable coverage options and discount programs.

8. Erie Insurance: Best Regional Option

Overall Rating

Erie Insurance offers some of the lowest rates for teen drivers in the states where it operates, with an average annual premium of $1,167 for teens with their own policies. Erie consistently ranks as one of the most affordable options for families adding a teen driver to their policy.

Available Discounts for Teen Drivers

- Youthful Driver Discount: Savings for unmarried drivers under 21 who live with their parents

- Youthful Longevity Discount: Additional savings for young drivers who have been Erie customers for several years

- Driver Training Discount: Discount for completing an approved driver education course

- College Credit Discount: Savings for unmarried college students who live away from home without a car

Unique Features for Teen Drivers

- Rate Lock: Locks in your rate until you add or remove a vehicle or driver, or change your address

- First Accident Forgiveness: No rate increase after your first at-fault accident after three years with Erie

- Diminishing Deductible: Your deductible decreases by $100 each year you're claim-free (up to $500)

- New Driver Protection: Prevents surcharges for first-time drivers who have their first accident

Pros: Consistently lowest rates in states where available Exceptional customer service ratings Unique Rate Lock feature Strong financial stability (A+ rating from AM Best)

Cons: Limited availability (only 12 states and DC) No usage-based insurance program No specific good student discount

Check Erie Insurance Availability

See if Erie's exceptional rates and service are available in your area.

9. Allstate: Best for Educational Resources

Overall Rating

Allstate offers teen drivers an average annual premium of $2,261 for their own policies. While Allstate's rates tend to be higher than some competitors, the company stands out for its extensive educational resources and programs designed specifically for teen drivers.

Available Discounts for Teen Drivers

- Good Student Discount: Up to 5% off for students with good grades

- Student Away at School Discount: Savings when your student is away at school without a car

- teenSMART Discount: Savings for completing Allstate's teenSMART driver education program

- Drivewise Discount: Savings based on safe driving habits monitored through Allstate's app

Unique Features for Teen Drivers

- teenSMART Program: Interactive driver training program that can help reduce crash risk and qualify for discounts

- Drivewise: Usage-based insurance program that monitors driving habits and rewards safe driving

- Milewise: Pay-per-mile insurance option that can be cost-effective for teens who don't drive frequently

- Accident Forgiveness: Optional feature that prevents rates from increasing after your first accident

Pros: Comprehensive teen driver education resources Strong local agent network for personalized service Multiple discount opportunities Innovative usage-based and pay-per-mile options

Cons: Higher base rates than many competitors Good student discount is lower than industry average Higher-than-average complaint ratio with NAIC

Explore Allstate's Teen Programs

Learn more about Allstate's educational resources and discount programs for teen drivers.

10. Liberty Mutual: Best for Additional Coverage Options

Overall Rating

Liberty Mutual offers teen drivers an average annual premium of $2,560 for their own policies. While Liberty Mutual's rates tend to be higher than some competitors, the company stands out for its extensive additional coverage options and customizable policies.

Available Discounts for Teen Drivers

- Good Student Discount: Savings for students with a B average or better

- Student Away at School Discount: Reduced rates when your student is away at school without a car

- RightTrack Discount: Up to 30% off based on safe driving habits

- Advanced Safety Features Discount: Savings for vehicles with advanced safety features

Unique Features for Teen Drivers

- RightTrack Program: Usage-based insurance that monitors driving habits and can lead to significant discounts

- Accident Forgiveness: Optional feature that prevents rates from increasing after your first accident

- New Car Replacement: Replaces your totaled car with a new one of the same make and model

- Better Car Replacement: Replaces your totaled car with one that's one model year newer with 15,000 fewer miles

Pros: Extensive additional coverage options Highly customizable policies Strong digital experience with robust mobile app 24/7 roadside assistance available

Cons: Higher base rates than many competitors No driver training discount Higher-than-average complaint ratio with NAIC

Customize Your Coverage

Explore Liberty Mutual's customizable coverage options and discount programs.

Comparison of Top 10 Auto Insurance Companies for Teen Drivers

| Insurance Company | Average Annual Premium for Teens | Good Student Discount | Student Away Discount | Driver Training Discount | Usage-Based Program | Accident Forgiveness |

|---|---|---|---|---|---|---|

| GEICO | $1,355 | Up to 15% | No | Yes | DriveEasy | |

| State Farm | $1,500 | Up to 25% | Yes | Yes | Drive Safe & Save | |

| Progressive | $1,670 | Yes | Yes | No | Snapshot | |

| USAA | $1,289 | Yes | No | Yes | SafePilot | |

| American Family | $2,273 | Up to 5% | Up to 16% | Yes | KnowYourDrive | |

| Travelers | $1,249 | Yes | Yes | Yes | IntelliDrive | |

| Nationwide | $2,347 | Up to 4% | Up to 5% | No | SmartRide | |

| Erie | $1,167 | No | Yes | Yes | No | |

| Allstate | $2,261 | Up to 5% | Yes | No | Drivewise | |

| Liberty Mutual | $2,560 | Yes | Yes | No | RightTrack |

Tips for Parents to Reduce Teen Car Insurance Premiums

Note: Rates reflect average annual premiums for teen drivers with their own policies. Actual rates will vary based on location, driving history, vehicle type, and other factors. Discount availability and amounts may vary by state.

1. Shop Around and Compare Quotes

Insurance rates can vary significantly between companies. Get quotes from multiple insurers to find the best rate for your teen driver. Online comparison tools can make this process easier and faster.

2. Keep Your Teen on Your Policy

In most cases, it`s cheaper to add your teen to your existing policy rather than purchasing a separate policy. Your established driving history and potential multi-car discount can help offset the cost increase.

3. Choose the Right Vehicle

The type of car your teen drives significantly impacts insurance costs. Opt for a safe, reliable sedan rather than a sports car or luxury vehicle. Vehicles with high safety ratings and anti-theft features often qualify for discounts.

4. Assign Your Teen to the Least Expensive Car

If you have multiple vehicles, assign your teen as the primary driver of the least expensive car to insure. This typically means an older, less valuable vehicle with comprehensive and collision coverage that has higher deductibles.

5. Maximize Available Discounts

Take advantage of all available discounts, such as good student discounts, driver training courses, and student-away-at-school discounts. Some insurers also offer discounts for vehicles with certain safety features.

6. Consider Usage-Based Insurance

Many insurers offer telematics programs that track driving habits and reward safe driving with discounts. These programs can be particularly beneficial for responsible teen drivers.

7. Increase Deductibles

Raising your deductible can lower your premium. Just make sure you can afford to pay the higher deductible if your teen is involved in an accident.

8. Maintain Good Grades

Encourage your teen to maintain good grades to qualify for good student discounts, which can save up to 25% with some insurers.

Important: While it's tempting to reduce coverage to save money, maintaining adequate liability coverage is crucial. Teen drivers are statistically more likely to be involved in accidents, so having appropriate coverage protects your family's assets in case of a serious accident.

Ready to Find Affordable Coverage for Your Teen?

Compare personalized quotes from top insurers to find the best rate for your family.

Frequently Asked Questions About Teen Car Insurance

At what age does car insurance go down for young drivers?

Car insurance rates typically begin to decrease when drivers reach age 25, assuming they maintain a clean driving record. However, you may see gradual decreases starting around age 21. Each year of safe driving experience helps reduce premiums. Some insurers also offer rate reductions when young drivers turn 19 or 21, or after they`ve been licensed for three years without accidents or violations.

Why is car insurance so expensive for teen drivers?

Insurance companies charge higher rates for teen drivers because statistics show they`re more likely to be involved in accidents. According to the Insurance Institute for Highway Safety, the crash rate per mile driven for 16-19 year-olds is nearly three times the rate for drivers 20 and older. Teens lack driving experience, are more likely to engage in risky behaviors like texting while driving, and are more prone to distraction. These factors make them higher-risk customers for insurance companies.

Should my teen have their own policy or be added to mine?

In most cases, adding your teen to your existing policy is more cost-effective than purchasing a separate policy. When added to your policy, your teen benefits from your established driving history, potential multi-policy discounts, and other factors that can help offset the cost increase. Additionally, many insurers offer family discounts that wouldn`t be available with a separate policy. However, in some specific situations—such as if you have a poor driving record or your teen has their own car—a separate policy might make more sense.

What coverage do teen drivers need?

Teen drivers should have at least the minimum liability coverage required by their state. However, because teens are at higher risk for accidents, it`s generally recommended to purchase higher liability limits to protect your assets in case of a serious accident. If your teen drives a newer or more valuable car, comprehensive and collision coverage is also important. Additional coverages to consider include: Uninsured/underinsured motorist coverage Medical payments or personal injury protection Roadside assistance Rental car reimbursement

What are the best cars for teen drivers from an insurance perspective?

The best cars for teen drivers from an insurance perspective are typically mid-sized sedans or small SUVs with strong safety ratings, moderate horsepower, and advanced safety features. Vehicles with lower repair costs and theft rates also tend to be cheaper to insure. The Insurance Institute for Highway Safety (IIHS) publishes an annual list of recommended vehicles for teen drivers that balances safety, reliability, and affordability. Some examples of vehicles that often have lower insurance costs for teens include: Honda Civic Toyota Corolla Mazda 3 Subaru Impreza Hyundai Elantra

How can telematics or usage-based insurance help teen drivers?

Telematics or usage-based insurance programs can benefit teen drivers in several ways: Potential savings: Safe driving habits can lead to significant discounts, sometimes up to 40% Driving feedback: Most programs provide feedback on driving habits, helping teens identify areas for improvement Parental monitoring: Many programs allow parents to monitor their teen`s driving habits Incentive for safe driving: Knowing their driving is being monitored can encourage teens to drive more carefully Popular telematics programs include State Farm`s Drive Safe & Save, Progressive`s Snapshot, Allstate`s Drivewise, and GEICO`s DriveEasy.

Finding the Right Balance: Affordable Protection for Teen Drivers

Finding affordable car insurance for teens at top 10 auto insurance companies requires balancing cost with adequate protection. While teen drivers inevitably face higher premiums due to their inexperience and higher statistical risk, the strategies and companies outlined in this guide can help families find reasonable rates without sacrificing important coverage. The best approach is to compare quotes from multiple insurers, take advantage of all available discounts, and consider programs specifically designed for teen drivers. Companies like GEICO, State Farm, and Travelers consistently offer competitive rates and valuable programs for young drivers, but the best choice for your family will depend on your specific circumstances, location, and the type of vehicle your teen drives. Remember that while saving money is important, ensuring your teen has adequate coverage should be the priority. As your teen gains experience and maintains a clean driving record, you can expect insurance costs to gradually decrease, especially after they reach age 25.

Start Saving on Teen Car Insurance Today

Compare personalized quotes from top insurers to find affordable coverage for your teen driver.

Related Articles

Popular Posts